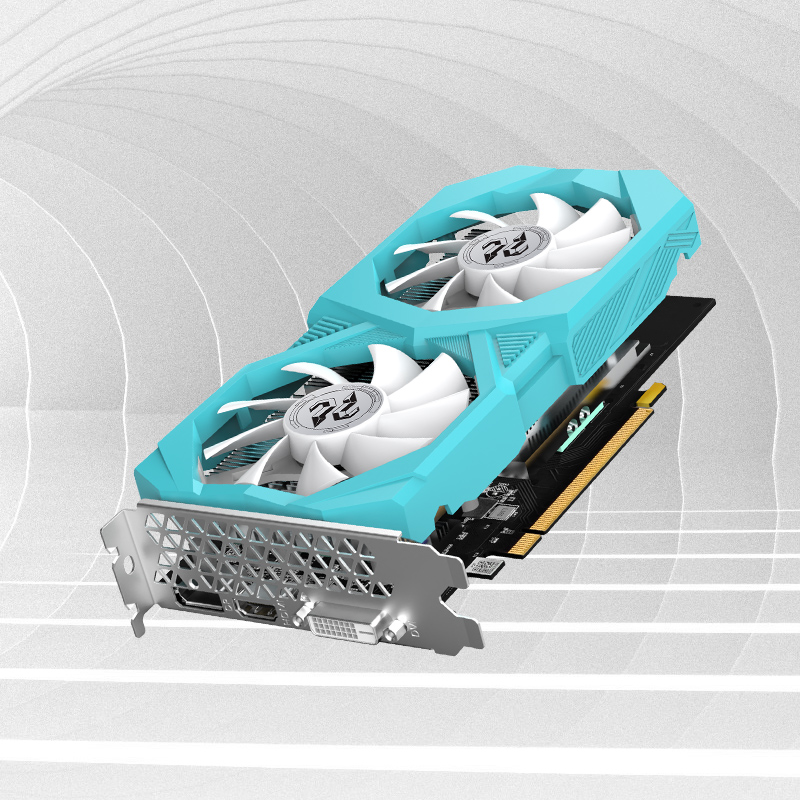

PELADN GTX 1660 Ti 6GD6 V2 Gaming Graphics Card 6G GDDR6 Gaming Graphics Card 192bit Dual Fans Cooling System

PELADN GTX 1660 Ti 6GD6 V2 Gaming Graphics Card 6G GDDR6 Gaming Graphics Card 192bit Dual Fans Cooling System

ASUS ROG Strix GeForce GTX 1660 Ti 6GB Overclocked Edition VR Ready HDMI 2.0 DP 1.4 Auto-Extreme Graphics Card | 90YV0CQ0-M0NA00 Buy, Best Price in Saudi Arabia, Riyadh, Jeddah, Medina, Dammam, Mecca

MSI Gaming GeForce GTX 1660 Ti 192-bit HDMI/DP 6GB GDRR6 HDCP Support DirectX 12 Dual Fan VR Ready OC Graphics Card (GTX 1660 TI Armor 6G OC) : Electronics - Amazon.com

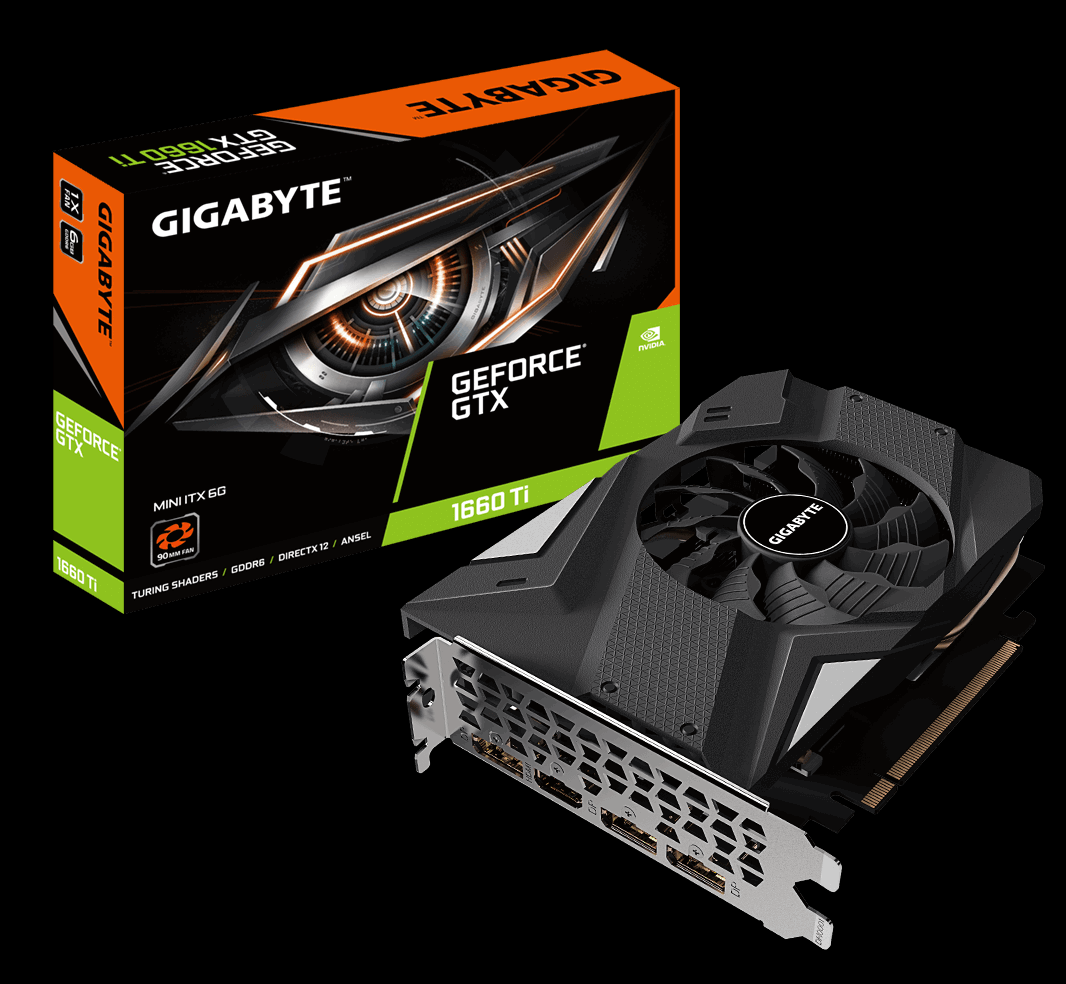

GIGABYTE GeForce GTX 1660 Ti MINI ITX 6G Graphics Card, Compact Mini ITX Form Factor, 6GB 192-Bit GDDR6, GV-N166TIX-6GD Video Card - Newegg.com

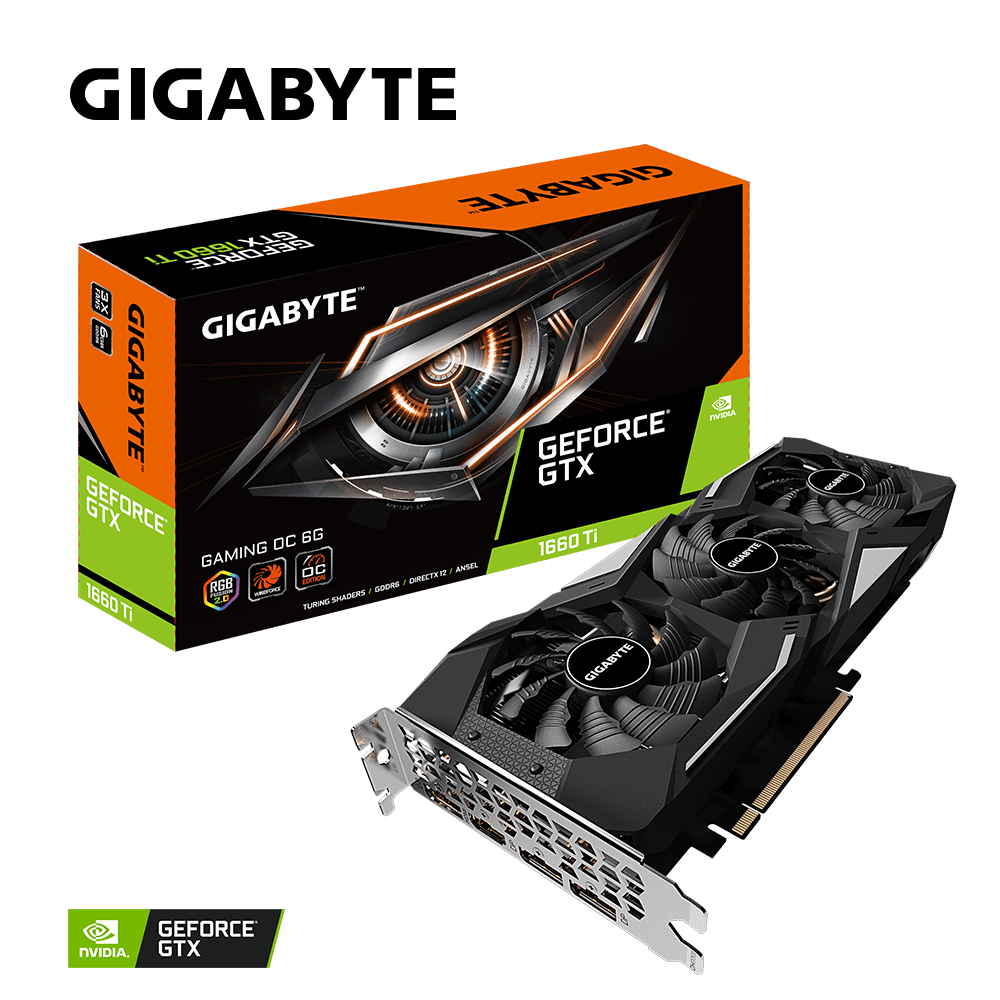

Nvidia Geforce Gtx 1660 Super Graphics Card | Gigabyte Gtx 1660 Super Gaming Oc - Crypto Mining Gpu Card - Aliexpress

Amazon.com: MSI Gaming GeForce GTX 1660 Ti 192-bit HDMI/DP 6GB GDRR6 HDCP Support DirectX 12 Dual Fan VR Ready OC Graphics Card (GTX 1660 TI Armor 6G OC) : Electronics

MSI NVIDIA GeForce GTX 1660 Ti Ventus XS 6G OC 6GB GDDR6 PCIe 3.0 x16 Desktop GPU MS-V375 VER: 1.2 | Jawa